The American Rescue Plan now allows for many Americans to lower monthly premiums and claim higher tax credits starting April 1, 2021, with open enrollment being extended to August 15, 2021. This will ultimately benefit those currently enrolled in a health insurance plan purchased through the Affordable Care Act. The result of this will cause most ACA marketplace participants to start seeing less expensive health insurance premiums, and many more Americans will now be eligible for affordable plans that would have been too expensive previously.

Main Takeaways

As of April 1, 2021, more financial help is available for consumers who get their healthcare coverage through the Affordable Care Act marketplace. 92% of people who buy their own health insurance will now qualify for a subsidy that can help reduce the costs. However, the new provisions are temporary and won’t extend past 2022 unless Congress makes these changes permanent.

Financial Changes

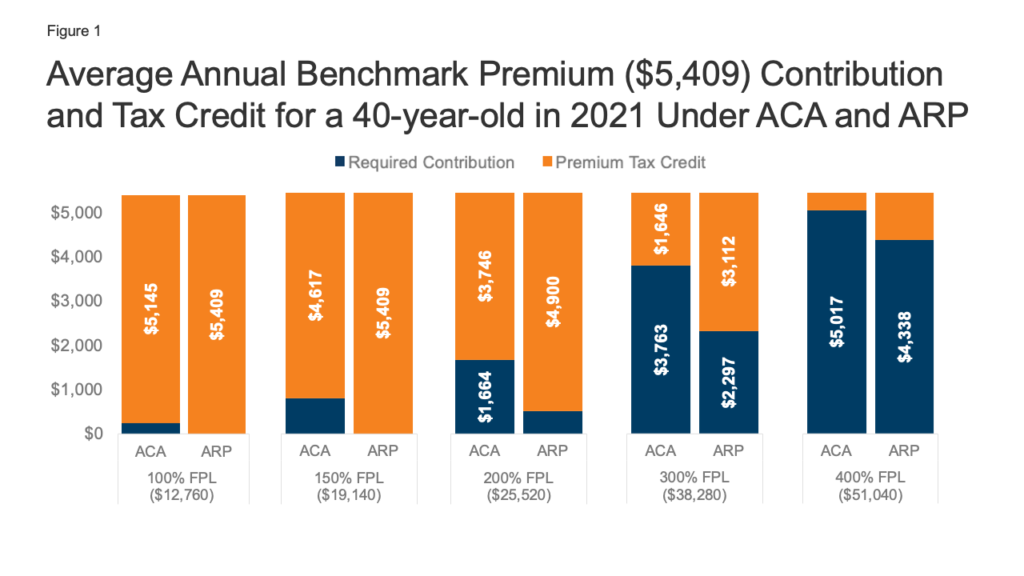

When observing the graph above, you can see the law eliminates an income cap previously in place. This determines who qualifies for ACA tax credits to help offset the cost of monthly insurance premiums. This now opens the door to people with incomes above 400% of the federal poverty level ($51,040 annually for individuals), who were previously ineligible for the tax credits.

It also limits the maximum amount anyone must pay for marketplace health insurance to 8.5% of income vs. 9.83%, and boosts subsidies to lower-income consumers—those with incomes between 100% and 400% of the poverty level (from $12,760 to $51,040 for a single person or $26,200 to $104,800 for a family of four).

Next Steps

People who want to enroll in a marketplace plan will be able to take advantage of the new changes starting April 1, 2021. As a reminder, the special enrollment period has been extended until Aug. 15, 2021 for uninsured consumers or those looking to change their plan.

If you already have a marketplace plan. we highly encourage you to update your enrollments or applications in order to take advantage of these increased savings. This will help allow the increased credits to take effect right away, and reduce premiums for the rest of the year. People who don’t update their applications now can also wait until they file their 2021 taxes next year to claim the added premium tax credit.

Why spend a lengthy time on the phone with the Marketplace when you can give us a call, and we can help you complete or update your application for coverage in under 15 minutes! Give us a call today to take advantage of the new lower rates! We’d be more than happy to help.